putnam county property tax rate

The median property tax in Putnam County Ohio is 1379 per year for a home worth the median value of 130200. The discounts and payment dates are as follows.

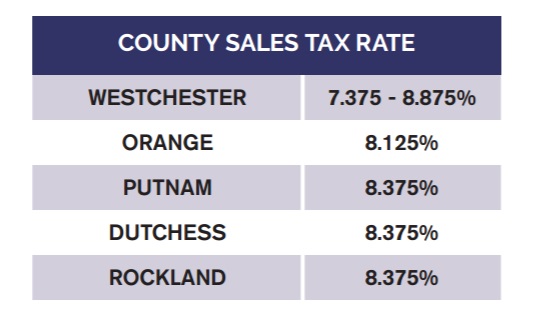

Hudson Valley Counties Tax Rates Highest In The United States

The median property tax also known as real estate tax in Putnam County is 733100 per year based on a median home value of 41810000 and a median effective property tax rate of.

. The median property tax also known as real estate tax in Putnam County is 93800 per year based on a median home value of 11980000 and a median effective property tax rate of. Putnam County collects on average 166 of a propertys. Convenience fees All Major Credit Cards Accepted 245.

The median property tax in Putnam County West Virginia is 776 per year for a home worth the median value of 135200. The median property tax in Putnam County Missouri is 792 per year for a home worth the median value of 98200. In fact the County.

106 of home value. EASY WAY TO PAY. Our office has no control over your property tax rate which is established by the Putnam County Board of Commissioners based on their budgets and spending.

Yearly median tax in Putnam County. Yearly median tax in Putnam County. Any tax payer wishing.

Putnam County Treasurers Office. Once market values are recorded your city along with other county governing districts will set tax rates independently. 064 of home value.

057 of home value. Yearly median tax in Putnam County. Putnam County collects on average 078 of a propertys assessed fair.

Yearly median tax in Putnam County. 081 of home value. The median property tax in Putnam County Indiana is 938 per year for a home worth the median value of 119800.

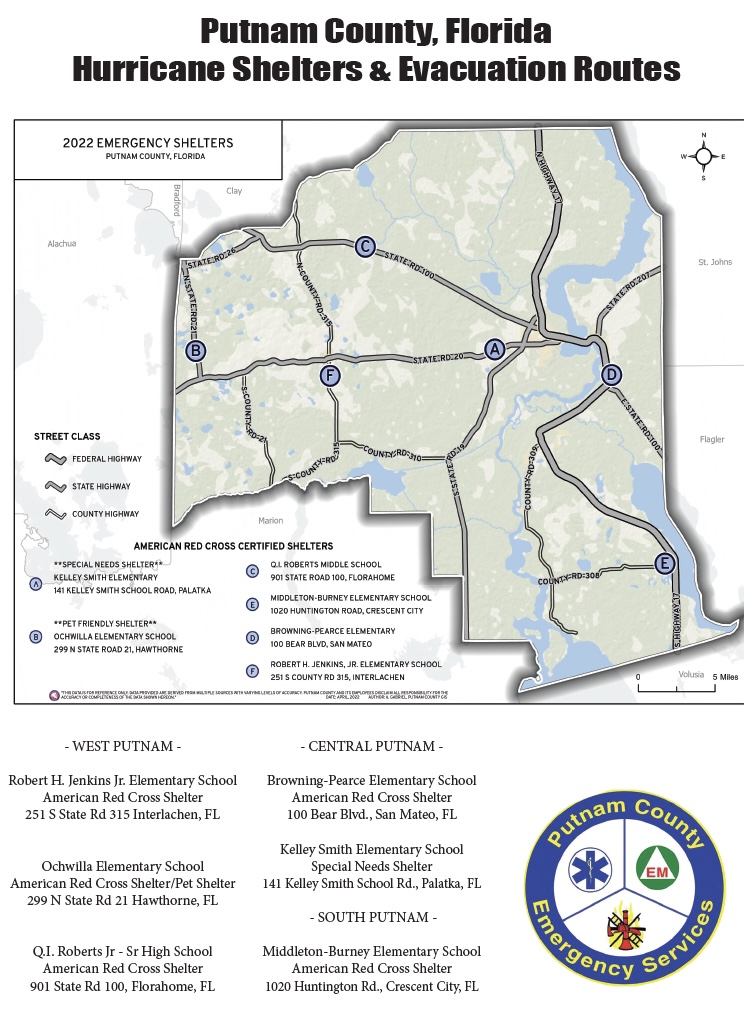

A composite rate will produce expected total tax revenues and also. The median property tax in Putnam County Florida is 813 per year for a home worth the median value of 109300. Whether you are already a resident or just considering moving to Putnam County to live or invest in real estate estimate local property.

1st installment is due by June 30 th. Start Your Homeowner Search Today. The rates listed are per 100 of Assessed Value.

See Property Records Tax Titles Owner Info More. Putnam County Local Property Tax Table. The median property tax also known as real estate tax in Putnam County is 81300 per year based on a median home value of 10930000 and a median effective property tax rate of.

Learn all about Putnam County real estate tax. Get In-Depth Property Tax Data In Minutes. The assessed value on real estate is based in.

Search Any Address 2. Yearly median tax in Putnam County. Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ per month.

3 penalty and advertising fee applies to unpaid real property taxes. What is the property tax rate in Putnam County NY. Putnam County Property Appraiser.

074 of home value. Local property taxes in Indiana are paid in arrears. All Debit Cards 395.

The median property tax also known as real estate tax in Putnam County is 74700 per year based on a median home value of 15760000 and a median. Sheriff Bobby Eggleton Bobby Eggleton is one of the most experienced law enforcement officers in Putnam County. The median property tax in Putnam County Tennessee is 797 per year for a home worth the median value of 124000.

In Florida Property Appraisers are independent constitutional. Customers who pay by installment method are eligible for a discount for early payment of their taxes. The median property tax in Putnam County Illinois is 2049 per year for a home worth the median value of 123600.

Putnam County Commissioners Pass Resolution Supporting Passage Of Amendment 2 Wchs

List County By County Median Property Taxes In Florida

Property Tax By County Property Tax Calculator Rethority

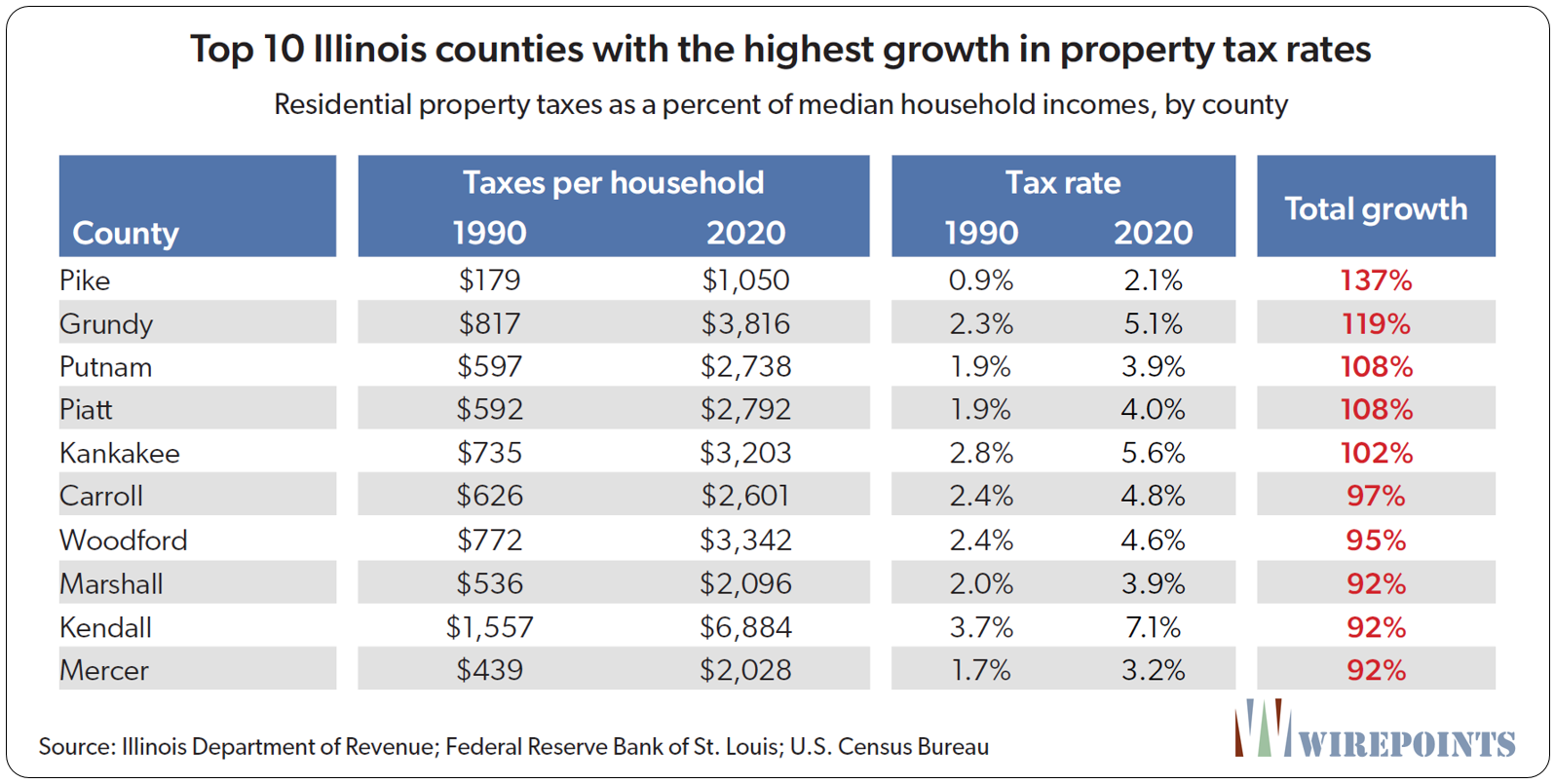

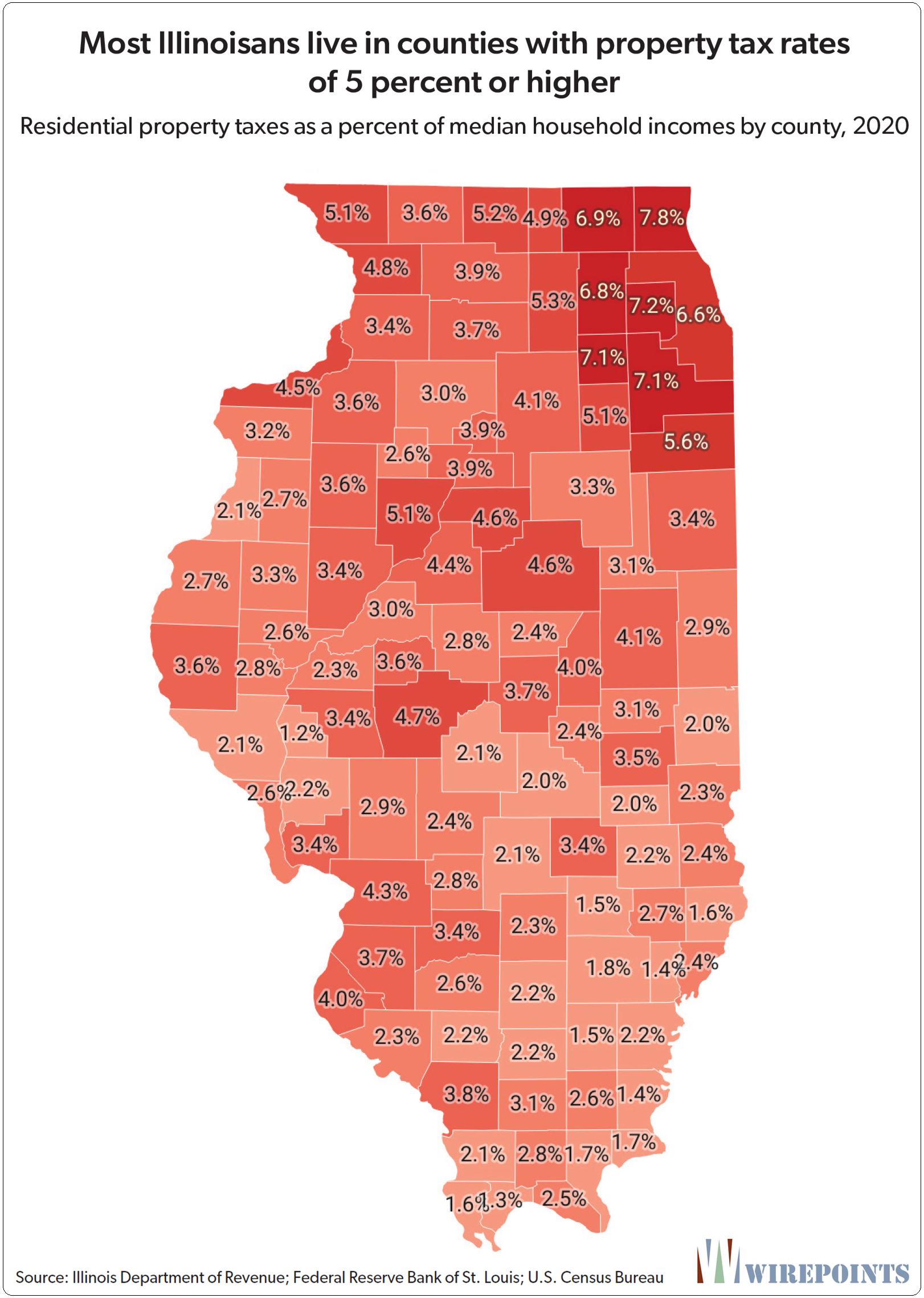

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Putnam County Tax Assessor S Office

Putnam County Announces No Property Tax Increase Putnam County Online

Putnam County Tax Assessor S Office

Greencastle Putnam County Development Center Putnam County Local Property Tax Table

As Putnam County Students Head Back To Class District Plans To Repair Rebuild Aging Schools

Putnam County Florida Wikipedia

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Property Tax By County Property Tax Calculator Rethority

New York Property Tax Calculator Smartasset

Putnam County Property Tax Inquiry

County Board Adopts Budget Property Tax Rate Palatka Daily News Palatka Florida

Palatka Daily News Palatkadaily Twitter

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation